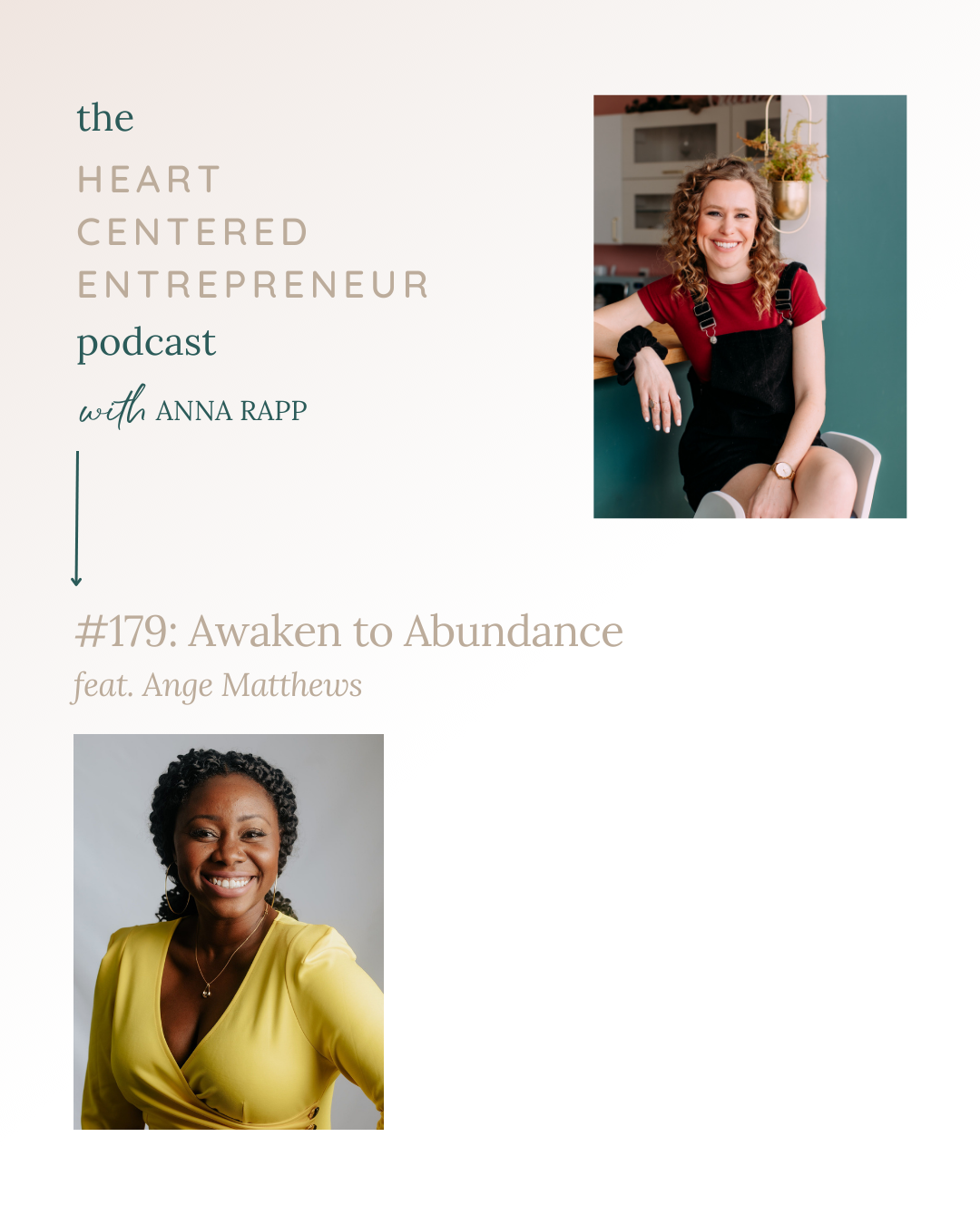

Awaken to Abundance with Ange Matthews

Episode Summary:

Friends this whole podcast episode is FULL of nuggets on embracing financial abundance. Ange Matthews, an Investor, Investment Coach and the founder of the Happy Investor Method, is joining me on the podcast today and is so full of kindness. In our conversation, she’s breaking down the fears that come with investing, reminding you of your birthright when it comes to money, and teaching you the importance of healing your relationship with money. This episode is perfect for anyone, but especially those women who have created their $20K Freedom Fund and are ready for the next step of increasing their wealth.

Topics Discussed:

Ange’s story from moving out of credit card debt and other financial trauma into an Investment Coach and the founder of the Happy Investor Method

The concept of money being forgiving and how it’s a reminder that no matter what, things can still be okay

Some things that money may say to you so that you could awaken to abundance and start digesting change

The reminder that the relationship you have with money is a lifelong one and what the continual process of this looks like

Some of the work that Ange does with women in the investing realm to make her clients happier and wealthier

The advice that Ange would give someone who is just starting out with investing

Episode Resources:

About Ange:

Ange Matthews is an Investor, Investment Coach and the founder of the Happy Investor MethodTM, where her goal is to make investing accessible and fun for all. Through her step-by-step investing blueprint, Matthews has helped thousands of individuals and businesses learn how to use the stock market to change their lives.

Connect with Ange:

Apple Podcasts | Spotify | Google | Stitcher

-

Anna Rapp (00:02):

Hello friends, I am so excited to have a special guest today on the podcast, Anang Matthews. You guys know we've been talking a lot more about money and financial security and stability lately, and so I wanted to bring Anang on to add to this conversation of how to not just save money and create money, but how to increase your wealth through investing. So take us away, tell us a little bit about yourself.

Ange Matthews (00:29):

Well first, thanks for having me on. This is such a special conversation to be in.

Anna Rapp (00:34):

So grateful to have you here.

Ange Matthews (00:36):

Well, money is a beautiful place to, to, to really be in and to talk about because it's something that a lot of people struggle talking about openly and I think it's a place where there's so much love, there's so much abundance, there's so much freedom and joy available, but it's one that we get to choose. And I think people don't realize that I think we have a default way to be with our money and especially around investing. And so I'm just here to talk a good message and preach the good faith about like we get to all have amazing relationships with our money. Our money gets to grow and have babies and come back with friends and it gets to be easy and effortless.

Anna Rapp (01:19):

I lo, I mean I absolutely agree. Tell me like was there a point in your life where it didn't feel that way, where it didn't feel like money was easy and effortless or were you born this way?

Ange Matthews (01:33):

I think I was born this way and I think we were all originally born this way. I will clarify. I think we all popped off the womb thinking life is amazing and abundant and then you go to the store and you ask for something and spread a lot of us, you got the answer. Money doesn't grow in trees, put it back. And at least that's what I got <laugh>. And so, and I actually thought money did grow on trees and you know, I probably could have been that smart Alec kid who said yes it does it's paper. So technically it does grow on trees. But thankfully I didn't have the smart Alec enough answer to say that cuz I probably would've got popped. So, you know, God won't give you what you can't handle and thankfully I didn't have that answer. So <laugh>

Anna Rapp (02:18):

It's a clever answer though, <laugh>.

Ange Matthews (02:19):

It's a, it's a darn good one. And now I totally think we all knew it was up in the beginning. But I didn't necessarily grow up with this amazing abundance mindset actually when I grew up it was in severe lack and I grew up around a conversation of debt and my family came to this country. So I came from a family where they immigrated in the seventies and I'm first generation American and they were really great at working hard, making sure that we had a great education. So they invested a lot in our education. My sister was really great at school. She got into the best schools and they took out a ton of student loans for her smart, you know, being so smart. So she went to Columbia and did all the things. And so when it was my turn to go, there was really no more like no more money left and no good credit score left.

Ange Matthews (03:12):

And so I really had to finance a lot of my life and my education myself and I was really the type where I'm still gonna enjoy it. I'm still gonna enjoy life, I'm still gonna live an abundant way cuz I think I always had an abundant mindset and I racked up credit card debt, I did all the things wrong. You know when they're like, oh invest in your twenties or invest early. Yeah, I didn't do it like most people. And it's just so ironic that I now teach about investing and money because I think I'm the poster child of you should probably not be the one teaching this. If I saw myself 20 years ago, I would literally laugh at laugh at the person who said it was to be.

Anna Rapp (03:54):

But also you're the perfect person to be teaching this, right? Because you can get where people are at in not having their together around this.

Ange Matthews (04:02):

Oh absolutely. You know, when I sit in meditation and I go through those like why me moments? And I think a lot of us every now and then do, especially when you are put on a path to do something when no one looks like you or no one comes from your background like I do, you know, as a woman of color, as a person who's my age, I don't look like the typical person to talk about money. And I'm just like, really? What was the plan here? <Laugh>? And it's like, well I mean you are the plan. Like hello <laugh>, like what better messenger to have this message? Like you can mess it all up and it can still be okay.

Anna Rapp (04:37):

I, I love what you just said, you are the plan and it's safe for you to mess it up and still be okay. I think that's an amazing message is women to hear when we feel like there's something that we're gonna do to like screw up our divine plan or our path, right? There really is nothing we can do to screw it up.

Ange Matthews (04:55):

No, there isn't and there's something so forgiving about money. There just is. And I think when we think about our lives and the path we've taken with our money and the mess-ups that we've had, when you still look at the lifestyle that for a lot of us that we have, it still shows up for us when you, you know, for entrepreneurs, when you look at a client that still pays us or a sale that comes in, you're like, and you're still here and you still show up for us, right? Like it's just kind of crazy to me that we could still get paid for what we do and we show up and we, we provide, you know, our services. And when I think about investing, the fact that I could have invested in something 10 years ago, five years ago and I'm still getting paid for it, it's like mind boggling to me.

Anna Rapp (05:44):

Mm-Hmm <affirmative>, talk to me more about that conversation of money is forgiving because I find that as I talk to a lot of women, they do have like a lot of guilt or shame around like past mistakes or like whether they were their fault or not, right? But talk to me about this money is forgiving concept.

Ange Matthews (06:05):

So I do think that we have a lot of financial trauma, you know, going through our lives and we inherit a lot of financial trauma. We create our own financial trauma and especially as women, we're hard on ourselves. Yeah. And forgiveness is really one of those things that we don't do it enough and we don't forgive ourselves. Sometimes we're quicker to forgive other people rather than ourselves. Yes. And there are many reasons for that. There's a payoff to not forgiving, right? It just feels good to hold a grudge sometimes because what happens once you forgive, there's a whole extra set of work that you get to do when you don't have a grudge. And so when I think about money being forgive, forgiving, I like to think about, well what if you had a narrative of yes there was a mistake that was made. Yes, maybe we invested in a program that didn't work out or yes, maybe you bit off too much that you could chew right?

Ange Matthews (07:04):

In creating something and being like, whoa, I'm over my head. Or maybe you took out a loan or whatever it is. And then a lot of times we get on ourselves and we're like, I can't believe I did that. I can't believe I did that. That was so foolish of me that was so stupid of me. How could I take out that interest rate? How can I do that? And then it just prevents you from moving forward and then it builds this whole narrative in you. Every time you wanna do something else, you think, remember that one time that you messed up? Remember that one time that I messed up? There's this like money shamer going like shame, shame, shame in the background. And what I like to do with my clients and our orientation, I have them just write a letter of forgiveness and it's like, can you forgive yourself?

Ange Matthews (07:51):

Can you forgive your money? And then can you also at the same time hear your money saying, I forgive you. Can you hear your money saying I forgive you for treating me this way. And it's such a really weird way to think about your money, but it's like your money loves you and I know for someone thinking about like what are you talking about, money feeling this way? But everything is just energy, right? And if you can see money in this way as money forgiving you as money, loving you as money just wanting to love up on you, well then you're gonna be like, well come on over money. Like, you love me, I love you. I feel like we should just be together already.

Anna Rapp (08:34):

I love this. This analogy's gonna resonate so much with the Heart-Centered Entrepreneur podcast listeners because I know that's how they are in their life. They love their family, they love their clients, they lo like they, they really resonate with this term of like love and in genuine care and integrity and trust. And so I have never heard anyone talk about money this way in the sense of like that intimate relationship. And so I just love this translation and what I like to do with my audience a lot is a little bit more experiential thing. So would you be down to try something with me?

Ange Matthews (09:12):

Yeah, let's

Anna Rapp (09:12):

Play. Okay. So like let's say some people that are listening to the podcast right now, they're like, this sounds amazing but also like I can't even conceptualize this. If you were the voice of money as they're listening to this in their car with their kids crying in the kitchen kitchen, like what are some of the things that money might say to them that they can start to awaken to or start digesting?

Ange Matthews (09:37):

Hmm. I love this. So money would say to you, it's okay, it's okay. I have been here from the time you were born and I will continue to be here every single step of the way. I will be here through the ups and I will be here for the downs. I will be here along the triumphant moments and I will be here even for your children and your children's children. I want to be here with you. I am a source of your very expression on this earth. I am here to do the work that you are meant to be doing on this planet. And I am an expression of your soul's purpose. I am money, am an extension of who you are truly meant to be.

Ange Matthews (10:41):

I am here to make your life easier and I want to make your life easier. I money long to be with you right by your side. I am money desire to have a deeper connection with you. I money forgive you. There is nothing you can do to keep me from you. I long to be with you just as much as I long to be with every single other being on this planet. There is more than enough of me to go around and I am a renewable resource. I am infinite period. And you are a badass with me. <Laugh>.

Anna Rapp (11:37):

I mean like just in the podcast right there like and clip so beautiful and powerful And if you're listening to that and that resonated with you, you may wanna hit rewind on this podcast episode and just replay that a few times, right? I'm a big fan of sometimes when we're something seems so new and foreign to us just using other people's words, using other people's templates or swipe files or like take the easy path and if this feels so foreign to you, borrow other people's beliefs and words and relationships with money until you can start to make it your own. And I just love how you said that. Thank you for giving that gift to my audience.

Ange Matthews (12:16):

Thank you for calling it in right. Let it be easy. And that's what we do. We all have superpowers and we can borrow each other's superpowers and yes, like you did that <laugh>. Yeah. Like we co-created that because if, if you're listening to this today, then somewhere in the universe this is what you desired and you co-created that right along with us.

Anna Rapp (12:42):

It's so true. You exactly. Like if you're listening to this podcast right now, it's not on accident. Like on you called that in, right? I fully believe that. I was reading some research somewhere recently that says we can talk about things, right? But what makes things integrate into our lives so much faster is when we experience them. And so I just think the script that you said and the feeling that you ladies got probably as you were listening to that, like really seeing how you can call more of that in with your relationship with money, right?

Ange Matthews (13:20):

Mm-Hmm <affirmative>. Absolutely. And one of the things I love to think about, especially if you're in the process of rewriting your relationship with money, I do want to tell you that it is a lifelong relationship. You know, some of us, we work on our money and you'll get some folks who say, oh, I've done that already. I don't need work on, I don't need work on my money. And I have grown so much, you know, considering where I have been and I don't talk about a lot about where I've been. And a lot of it is just because I don't enjoy remembering it and I'm working. I'm literally in the midst of working through that cuz I realize that sometimes that's me ignoring the blessings that I've been through. But it trips me up cuz I get survivor's guilt and all that stuff. Like, ugh, like why me? I get why me feelings. Yeah. And I'm like, maybe I should just keep working at what I'm doing. But the reality is it's a continual process and no matter how high you go, you're always gonna come into a new relationship and a new depth with money. And the only advice I can give to someone out there who's listening right now is you better get real comfortable with being uncomfortable with money,

Ange Matthews (14:33):

Period. Like you need to just sit in there like there's always going to be a, a flow of it will come and go. It's like kids, right? They're gonna be wanting to be around you and smother you with hugs and kisses and you're gonna be like, this feels amazing. And they're gonna be like, lemme go, lemme go. And then you're just gonna have to open your arms and just let it flow. And that's really the vibration that money has. It's always around us, but sometimes even as it's around us, it, it might not be like clinging to us even though it's around, right? And so you're gonna have to, and there's reasons for that. And so you're gonna have to really understand who you get to be in that song and dance of money. But really those words that we just said and those words that you just heard, you get to anchor in that and know that it really is a birthright. Like you were born to be abundant. Period. Period. And if that ever stops, it's not the money that's stopping it, it's really you <laugh>

Anna Rapp (15:33):

You're like, not to be personal but also <laugh>,

Ange Matthews (15:36):

But also, and we get to, that's when we get to take a pause in retrospect and think about like, well where's this block coming from? Like what's this upper level, this new dimension that I'm in right now that I've not experienced before that's creating this, this new level and relationship with my money and wealth?

Anna Rapp (15:57):

Yes. I love that because it's also very confronting and empowering to know that like, okay, it isn't money, it's me. So like therefore what can I do to shift this dynamic to welcome more money into my life? Right?

Ange Matthews (16:09):

And it's also sometimes, you know, for me personally when I find that money isn't in the physical cuz it's always around, right? So if it's not in the physical, sometimes I'm being called to level up, right? And so I know that universe and my team and who I am, they talk to me through money, right? That's a very clear way to get me to listen. You mess with my money. I'm like, okay, what, what, what are you trying to tell me now? Right? Like, like that's a very clear Angela wake up like we're talking to you. I may not listen but you, you you, you touch the bank account. Then I'm like, what's going on here is, is there something you want me to do? And so <laugh>, what I say this to say is that sometimes you might be operating as normal and the money may dry up a little bit and you might be thinking I'm doing something wrong and you can keep doing the same things.

Ange Matthews (17:05):

But then it might just be the universe is saying, no, no, no, no, no, I need to reposition you here. And then you reposition yourself and then all of a sudden things get back on track, more money comes. But if the money had been keeping going on the same way and you kept on in the same lane, you would've been stagnant and not doing what you were supposed to be doing. And so sometimes for some of us money is a compass. Yeah. And so I'm also saying that cuz maybe someone might need to hear that too. And it has nothing to do with you, it's just that also sometimes wealth is a compass for some of us as well and it forces us to up level and take on bigger goals and bigger dreams.

Anna Rapp (17:47):

Hmm. That's so true. What, which is a great segue too. I know your specialty is investing, right? And so when it comes to creating more money, like what is some of the work that you do with women in the investing realm? I'd love to hear about it.

Ange Matthews (18:07):

So I love to make people happy and wealthy and even though I talk a good game about money, I actually have one big purpose and it's really for them to figure out their purpose. And so even though the front door to my house is money, right? You step into the happy investor method and you're like make me a crap ton of money Ang. And I'm like yay. And then you step into the door and it's like, so why are you put on this planet? And I'm really clear that we're all meant to be wealthy so that we can live in a system where money isn't required for us to do what we're supposed to do. But I also understand in that understanding that you can't truly fulfill your purpose and what you're meant to do if you're constantly worried about how you're gonna feed your children and survive.

Ange Matthews (19:00):

It's a system that's not really compatible. And I know this because I was born into a system of what are we gonna do to keep the lights on? You can't really think about how you're gonna serve the world if you can't even think about how you're gonna feed your kids. It doesn't work out that way. And so yeah, just, just like really like think about that. And so that's why I love investing because it takes the question about you having to figure out how to feed your kids out of the picture because someone else is worried about that. Your investments are, they're growing and you aren't necessary to be in the picture. And I don't talk about past, I don't talk about active investing, I don't talk about get rich quick schemes, I don't talk about day trading or options or anything like that. I talk about good old passive dry, boring strategies that have worked long before we entered this world and that will work long after.

Ange Matthews (20:02):

And what I do is I add new age techniques to it that take conscious sustainable things and that kind of put them on hyper speed and that's why I love to do. And so I do that especially and I love doing it for women because we're the ones who typically sacrifice more. We're the ones who take care of everybody else and then we realize, oh, it's time for us to take care of ourselves. And investing works in the opposite way. It's the one of the only things where you can't throw more money at it to make it work faster. It's one of those things where it's like, no, you actually need time. It's like lasagna, it's like wine. You actually need time. And so what I found is for a lot of us, we don't, we can't make back time.

Ange Matthews (20:55):

And what I found is if you understand how to utilize strategies, well there's the fix. That's how we fix time. And so that's what I do. I teach strategies and I don't get too numbersy with them cuz that makes my head hurt too. I really wasn't the best and I know it spoke about my sister who was really smart and went to Columbia. You didn't notice, I didn't mention anything about myself in school. Did you, did you notice that I just said there was no more money for me? Well I didn't, I wasn't really the brightest light bulb in the tanning bed when it came to school going up. So my strategies are actually really common sense based and it turns out it actually works better. But that's why I teach investing and why I love talking specifically to women, people of color, people who have been left out of the conversation cuz we're the ones who need it the most. We're the ones who need to catch up. And then that's when you get to figure out like, hey, this is why I'm put on this earth for. And if you're put on this earth to sit on the island or just sit in your backyard butt naked, go forth and do it.

Speaker 3 (21:59):

<Laugh>.

Anna Rapp (22:02):

I love it. I love that so much. <Laugh>. So many truth bombs in what you just shared. And I I mean it's so true. Like when it comes to like investing our money, right? Time is the most precious resource when it comes to like multiplying it. What advice would you give to someone who is just starting out? I shared with you before we hopped on that like I a lot of times help women like create that initial stability and create their reserve accounts, their freedom funds, right? But let's say someone is like, okay, check, I have stabilized myself, I have my savings account, I'm ready to start investing. What would you advise would be their first step?

Ange Matthews (22:45):

So I love this question because a lot of times people never know where to start and it makes them not start <laugh> and you end up going years not doing anything and you can start small. So one of the biggest misconceptions is that you need to have thousands of dollars to just start investing and that's absolutely not true. So we host a challenge every year and it's called the first stock challenge. And I do believe one stock can change your life, like one stock a month, one stock a week, it doesn't matter. Just start with one, one can change your life. And I firmly believe this cuz my dad said that when I was younger, one stock a one stock a year could have changed our lives. And he worked at an investment bank and never owned stock. So I believe that. And so when you're first starting out, you wanna start small because you don't wanna trick about your nervous system.

Ange Matthews (23:40):

So I never advocate taking like a thousand or 5,000 and just throwing it into something because if you do that and it doesn't work out, remember that negative Nancy mistake with money being that lives inside of you is gonna jump out and say, see, I told you you suck at this. You don't suck at it. You just didn't have training. And so we wanna start small, get a brokerage account like Robinhood, which is super easy, it's an app and just get one share in something very small like Target or Costco, not something that you never heard of a day in your life, right? Or just something very insignificant and see how it feels to actually own something, right? You wanna just start small and then check out a YouTube video, join our email list, right? And we do a lot of free trainings and stuff.

Ange Matthews (24:33):

Get educated. That's the second thing people do wrong. They just jump in. They and then they think that they're gonna be better than everybody else who's ever tried to do this since the world of investing. So that's not true. Pick up a book, look at a YouTube video, do something that's gonna give you a little bit of an edge and just start small. You know, when I started this path, I started back in 2008 and I got clobbered because the recession came right after <laugh>. And so it did and I got clobbered. I won't lie you, it's like someone who says, oh, I just learned how to swim and then they're gonna go surfing. And so I definitely got hit by a couple of waves, but I kept on, I stuck with it and because I endured, I ended up being a really great investor.

Ange Matthews (25:21):

And so once you see that this is something that works, you can do it. Like I said, I wasn't the best student. I didn't come from a ton of money and I'm a really great investor and my students, I mean I've got folks who are like in their sixties who start doing this like grandmoms and they do it. So you can do it. You once you set a budget to play with, maybe decide that instead of going out for lunch five days a week, maybe go out four days a week instead of for the kids instead of I don't know. I'm not really one to say budget a ton. I do like to live a good life, but I'm just saying like instead of for, you know, if the kids like Disney, maybe just buy Disney Stock one share. Do things like that and see how it feels. And then once you like it, actually start educating yourself.

Anna Rapp (26:15):

I love how doable and digestible you made it. If someone is listening and they're like, I love this, I wanna learn more about you. Tell people where they can. Number one, follow you online. Number two, join your email list, join your program. Tell us about how people can dive in with you more.

Ange Matthews (26:33):

Absolutely. So you can find me@happyinvestorguide.com gives you access to our latest freebie. So sometimes we have an audio guide, sometimes we'll have an affirmation. Sometimes we'll give like a deck, it changes. So as soon as you get there just throw your email in and then you'll get whatever's next. It's really that fun and spontaneous. I'm not, not super social. And the reason why is because I'm so dedicated to our clients and our students and our email list and I live a very full life and social media gives me a lot of anxiety. And so as a result I just don't mess with it. <Laugh>

Ange Matthews (27:11):

And you'll see, I'm pretty that as a matter of fact in real life, like either I mess with it or I don't. That's also a reason why I don't day trade. I don't have the anxiety for it. Like I don't look at the market every single day. I would freak out. That's why I'm a long-term investor. And so I'm the same way online and offline. And so if you wanna hang out with me, go to happy investor guide.com. Just join our email list and you'll get either a private podcast I think is what we have up now or you'll get a free training or something. And we do have a program called the Signature Course and that shows you how to actually do strategy. So like I said, once you dabble and you see that this is something you wanna do, I'd be more than happy to show you the way to being a happy investor. Either way, you've got this, you don't need to work really hard forever. Your money desires to work hard for you. That's actually the way it should be.

Anna Rapp (28:09):

Thank you so, so much for being on the show. I personally so enjoyed your affirmations and your story and your spirit and your kindness. Are there any final tidbits you want to leave women with that are listening?

Ange Matthews (28:26):

I'm so proud of you. Like wherever you are in your journey, I'm so proud that the world gets to see that you exist doing you on your own terms. And if the world should be so lucky enough to see that you on your own terms exist also as an investor, I think that would just be a fabulous cherry on top of all of it.

Anna Rapp (28:56):

I love. Thank you again for joining us for the show.

Ange Matthews (29:01):

Thank you for having me, Anna.

PS: In the midst of this challenging time I’ve been asking myself what I can do to help? One of the #1 ways I support my clients is by helping them simplify their business so that they can increase the flow of money without creating extra work. In this season simplified visibility and sales is needed more than ever.

So if you’re craving personal support as you reposition your free and paid work, I’d love to help you simplify your sales process so that you can produce income in your business even during a challenging time. If you want support you can check out my services and book a free discovery call here, or you can send me a DM on Instagram.